unified estate and gift tax credit 2021

Estate and Gift Taxes. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or.

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person.

. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. The 2021 federal tax law applies the estate tax to any amount above 117 million. What Is the Unified Tax Credit Amount for 2021.

The Illinois Estate and Generation-Skipping Transfer Tax Act 35 ILCS 4051 et seq may be found on the Illinois General Assemblys website. The gift and estate tax exemptions were doubled. For 2021 that lifetime exemption amount is 117 million.

It increased to 1206 million in 2022. WHEREAS the Company seeks an EDGE tax credit for its business development located at 14101 South Seeley Avenue Blue Island Illinois as more fully described in Section IV the Project and the Department agrees to award an EDGE tax credit to the Company for the Project subject to the terms and conditions set forth herein. 86 2000100 et seq may be found on the Illinois General Assemblys website.

Scheduled deadlines for submitting 2021 federal LIHTC applications and related information. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. Taxable Estate Base Taxes Paid.

The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. What Is the Unified Tax Credit Amount for 2021.

Learn about the COVID-19 relief provisions for Estate Gift. The previous limit for 2020 was 1158 million. Gift and Estate Tax Exemptions The Unified Credit.

Attorney support in select states. Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. For 2021 the estate and gift tax exemption stands at 117 million per person.

An Illinois Inheritance Tax Release may be necessary if a decedent died before. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Illinois estate tax regulations Ill.

The estate tax is a tax on your right to transfer property at your death. Updated as new information becomes available. Start Your Tax Return Today.

You could either pay the gift tax on the additional 4000 over the 16000 annual exclusion or you could apply it to the unified lifetime exemption. Max refund is guaranteed and 100 accurate. Find some of the more common questions dealing with basic estate tax issues.

This is called the unified credit. Trusted by over 200k members. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed.

Unified Estate And Gift Tax Credit 2021. Free means free and IRS e-file is included. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift. Any tax due is determined after applying a credit based on an applicable exclusion amount.

The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax. The Illinois estate tax applies to estates exceeding 4 million. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Ad All Major Tax Situations Are Supported for Free. However this is set to expire in 2025 at which time the credits will drop back down unless new legislation is passed.

It consists of an accounting of everything you own or have certain interests in at the date of death. Ad Inheritance and Estate Planning Guidance With Simple Pricing. The chart below shows no taxes owed on the first 40000 of taxable income because of a system of tax credits from the state Illinois Estate Tax Rates.

The tax is then reduced by the available unified credit. On top of this tax the estate may be subject to the federal estate tax. Then there is the exemption for gifts and estate taxes.

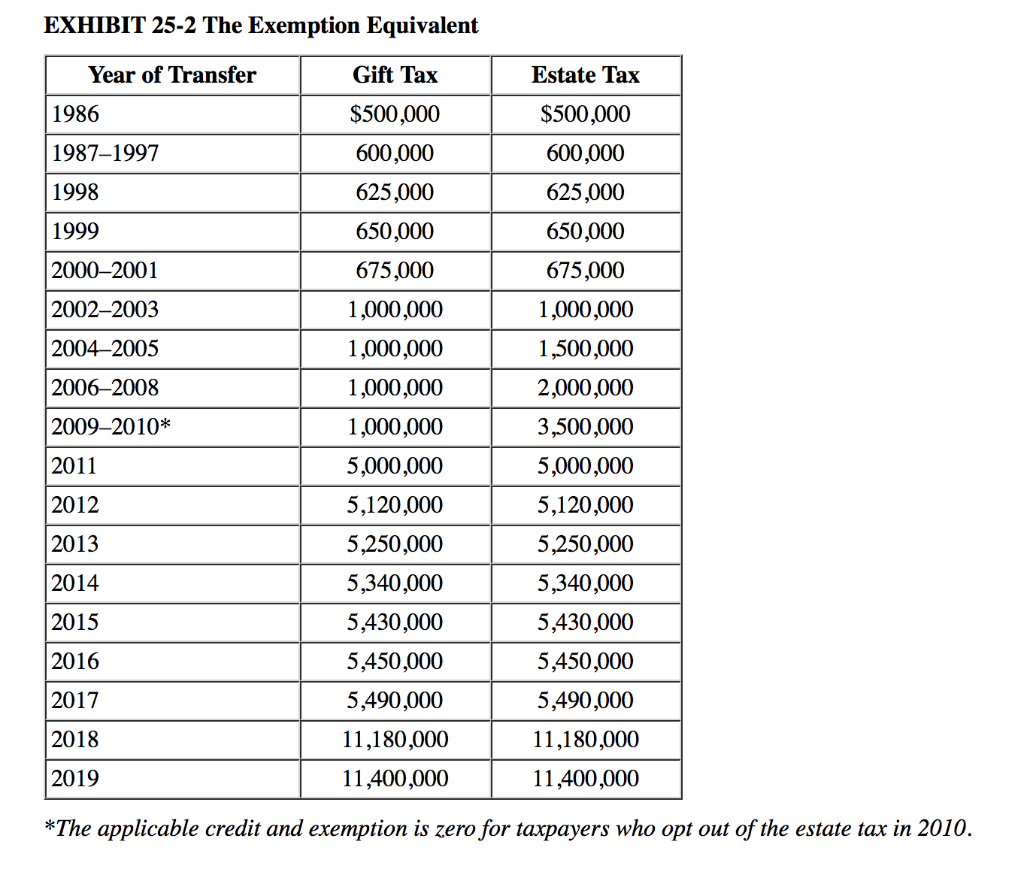

So individuals can pass 117 million to their heirsand couples can transfer twice that amountwithout. The lifetime exemption was worth 117 million for tax year 2021. The estate and gift taxes are based on a series of graduated rates that start at 18.

The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due. A key component of this exclusion is the basic exclusion amount BEA.

Federal Estate Gift Taxes Code Regulations Including Related Income Tax Provisions As Of March 2019 Cch Tax Law Editors 9780808048091 Amazon Com Books

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

No Need To Fear A Federal Claw Back Twomey Latham

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Historical Look At Estate And Gift Tax Rates Wolters Kluwer

Federal Estate Gift Taxes Code Regulations Including Related Income Tax Provisions As Of March 2019 Cch Tax Law Editors 9780808048091 Amazon Com Books

Gift Tax Explained 2021 Exemption And Rates

Updated 2022 Estate And Gift Tax Rates Tucker Arensberg P C Jdsupra

Direct Payment Of Medical Expenses And Tuition As An Exception To The Gift Tax The American College Of Trust And Estate Counsel

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Estate Planning Estate Tax And Trust Tricks Traps For Married Couples Retirement Watch

Warshaw Burstein Llp 2022 Trust And Estates Updates

Gift Tax Explained 2021 Exemption And Rates

Federal Estate Gift Taxes Code Regulations Including Related Income Tax Provisions As Of March 2019 Cch Tax Law Editors 9780808048091 Amazon Com Books

Gift Tax Explained 2021 Exemption And Rates

2016 Federal Estate Tax Exemption Amount Wills Trusts And Estates